Introduction

Did you know that only 43% of regulated organizations are fully PCI DSS compliant, exposing many to potential data breaches and non-compliance penalties? Fines for PCI DSS non-compliance can range from $5,000 to $100,000 per month, depending on the violation’s severity and the business’s size. High-profile breaches like those at Target and Home Depot resulted in settlements and penalties of millions of dollars, demonstrating the costly consequences of failing to meet PCI standards. This article will show how HoundDog simplifies compliance, helping you avoid these financial and reputational risks by automating data flow monitoring, PII tracking, and third-party risk management.

Get Control of Data Flows with PCI DSS 1.2 Compliance

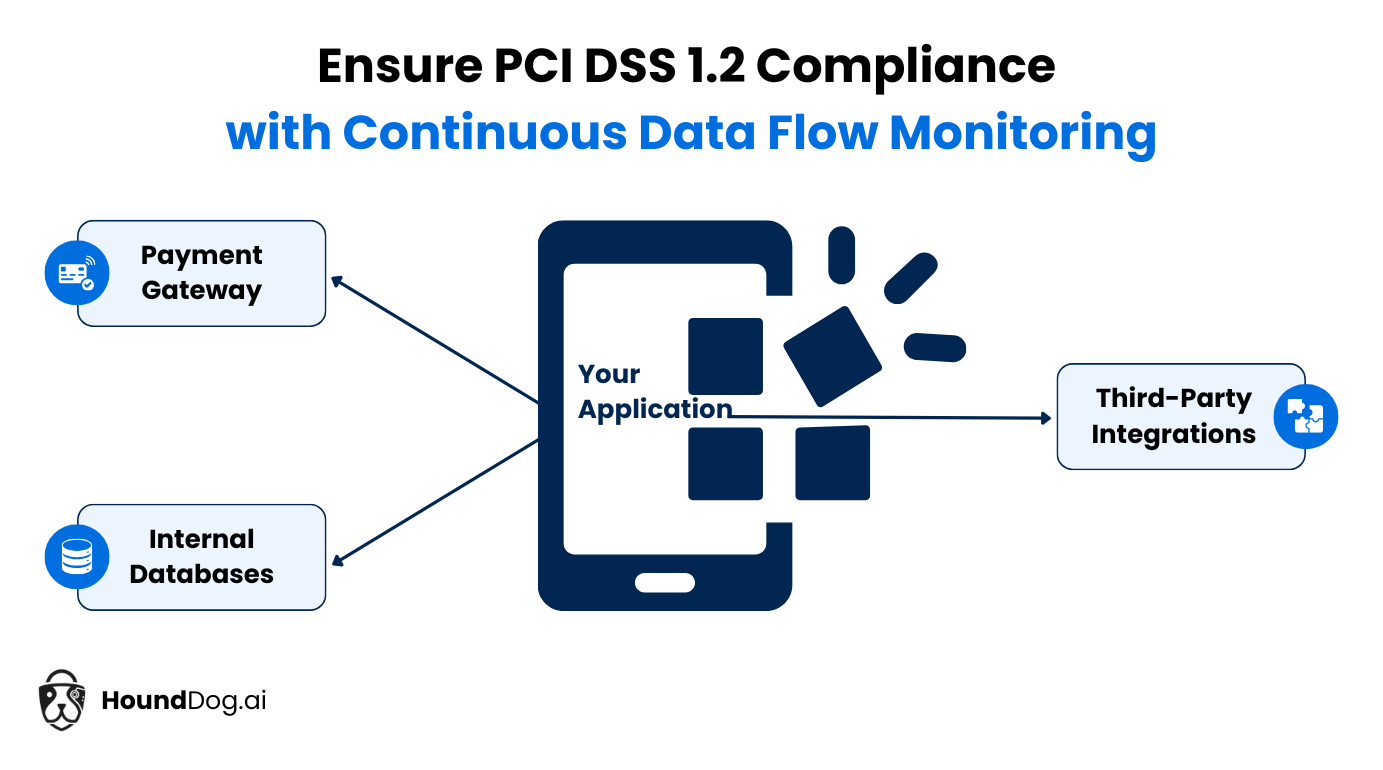

Under PCI DSS Requirement 1.2, organizations must map how cardholder data (CHD) and personally identifiable information (PII) move through their systems. This helps keep sensitive data secure by showing exactly where it’s processed, stored, or transmitted. Without this visibility, it’s tough to meet compliance standards and even tougher to protect data from breaches.

Companies often over-rely on data already collected in production and monitoring network traffic to map out data flows within their applications. However, due to the high development velocity of many applications, unpushed code changes and their impact on data flows often go undetected. As a result, compliance teams are left reacting to changes, with little to no input on modifications that could lead to compliance violations

How HoundDog Helps

HoundDog helps you stay on top of PCI DSS Requirement 1.2 by automating the entire process of mapping data flows. The platform relies on your application’s source code as the single source of truth to continuously track how CHD and PII flow through your application, ensuring you are always aware of all storage mediums and third-party integrations where your sensitive data will ultimately be stored. With HoundDog, you can trust that all your data flows are proactively monitored before your code is pushed to production, even when working with third-party processors and complex integrations.

Our platform doesn’t just track data it highlights risky or undocumented data flows that might violate PCI DSS before they become a problem. Identifying these risks early in development can address compliance issues long before they hit production, saving time and preventing costly mistakes later. This proactive approach makes managing compliance much easier and helps reduce the chances of violating PCI DSS standards.

Easily Manage Sensitive Data for PCI DSS 3.1

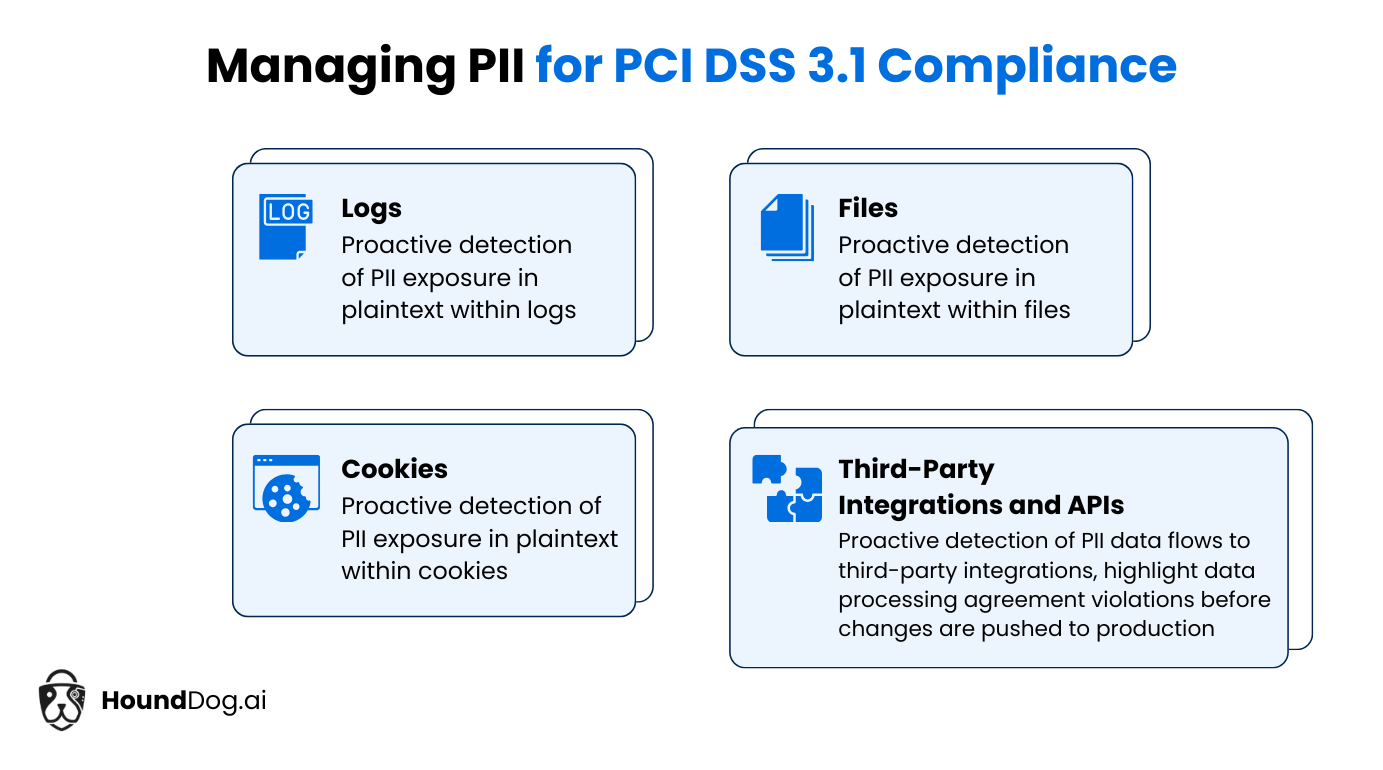

PCI DSS Requirement 3.1 is all about securing stored cardholder data (CHD), but many organizations struggle with identifying exactly where their personally identifiable information (PII) is stored, processed, or transmitted. Tracking all instances of PII across various systems and environments isn’t easy, especially as data flows through different tools and integrations.

One common issue is that organizations often lack full visibility into their codebases, leading to accidental PII exposure and potential non-compliance. Without a clear inventory of where PII lives, it’s easy for sensitive information to slip through the cracks, increasing the risk of data breaches or compliance failures.

How HoundDog Helps

To address this challenge, HoundDog provides proactive tracking of PII across your applications. The platform’s static code scanner continuously tracks PII exposure across logs, cookies, files, and APIs, enabling you to create a custom allow list that aligns with your policies.

This proactive approach helps catch potential PCI violations caused by unintentional developer mistakes, such as oversharing or overlogging data that may contain PII or CHD, before the code is pushed to production and the data is exposed. With this level of proactive visibility, you can be confident that your PII is securely managed, ensuring compliance with PCI DSS 3.1 requirements before any violations occur in production

When it comes to audits, HoundDog helps you stay prepared by automatically generating and maintaining Records of Processing Activities (RoPA). This ensures that all collected, processed, and stored PII is fully documented and up to date, making PCI DSS compliance audits far easier to manage. With the documentation handled, you won’t need to scramble when audit time comes around, giving you more time to focus on other priorities while staying compliant.

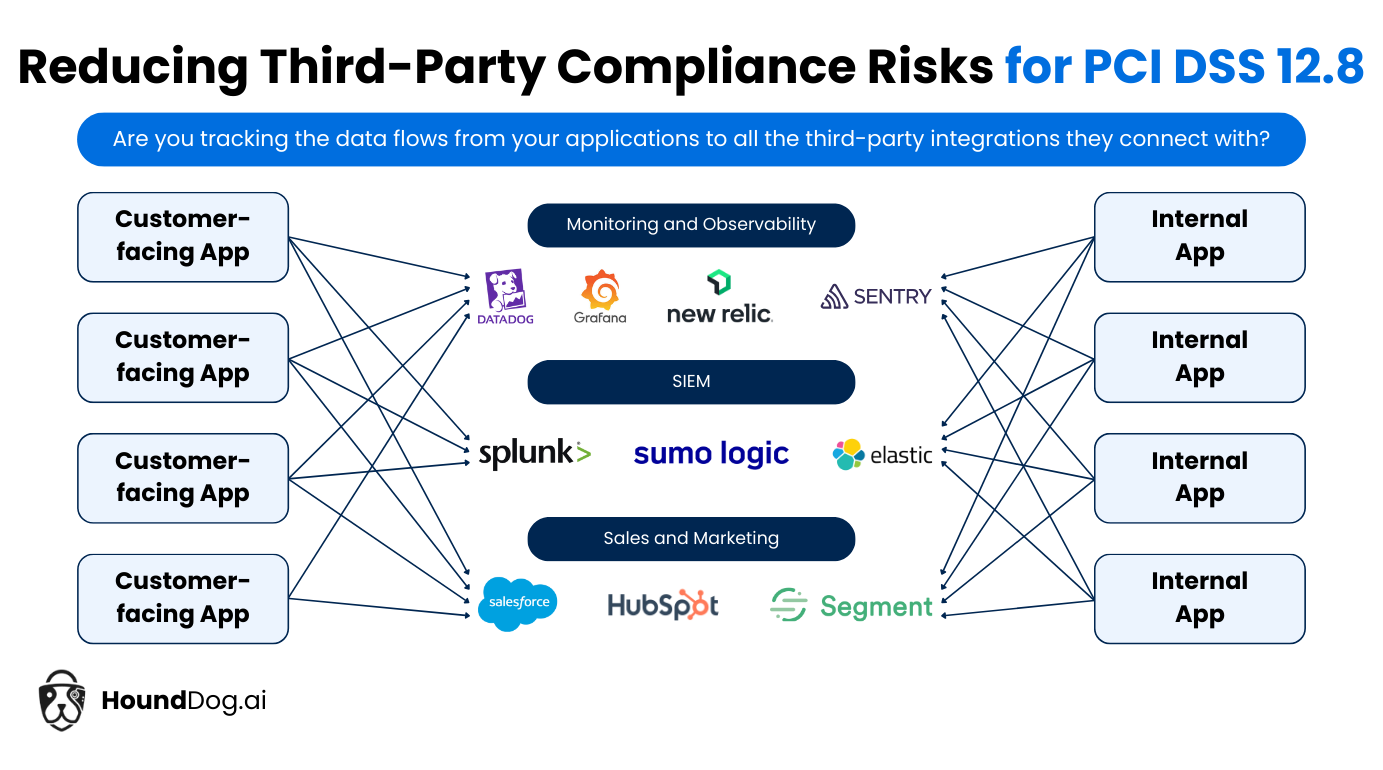

Reduce Third-Party Risks with PCI DSS 12.8

Under PCI DSS Requirement 12.8, monitoring and managing all third-party processors is mandatory to ensure they meet PCI security standards. Anytime you’re sharing cardholder data (CHD) or personally identifiable information (PII) with vendors, it’s up to you to ensure they follow the rules. However, keeping tabs on these interactions can be difficult, especially when data flows through multiple third-party services.

One of the organizations’ biggest pain points is maintaining third-party compliance. With so many vendors and data-sharing agreements, it’s easy to lose track of how and where data is shared. This lack of oversight can expose your organization to compliance violations and security risks.

How HoundDog Helps

To make this easier, HoundDog offers automated third-party data flow monitoring, continuously tracking interactions between your applications and outside services. The platform provides proactive visualization of data flows, allowing you to see exactly how CHD and PII are being transmitted and shared with third parties.

HoundDog also flags potential compliance risks early, long before they escalate into production issues. This level of visibility helps you stay on top of data-sharing practices, ensuring third-party compliance while preventing unauthorized access to sensitive information.

What makes HoundDog even more effective is its ability to help you address third-party risks early in development. You can avoid needing emergency fixes or costly remediation efforts by catching compliance issues before they hit production. This proactive approach reduces the risk of non-compliance and saves your organization from potential penalties, giving you peace of mind when managing third-party relationships.

Conclusion

In this article, we explored how HoundDog automates PCI DSS compliance by tracking data flows (PCI DSS 1.2), managing PII inventory (PCI DSS 3.1), and monitoring third-party risks (PCI DSS 12.8). These tools help you maintain visibility, catch risks early, and stay compliant without the hassle. If you’re ready to simplify PCI compliance and protect sensitive data, schedule a demo with HoundDog today and see how we can help you stay secure.